Author Archive

Anchor Text Analysis With Ahrefs

14

One of the many reasons why Ahrefs is my tool of choice is its ability to break down an anchor text profile quickly and efficiently.

In this post, I’ll show you how quick it is to spot potential issues and how deep you can actually dig with this feature of an Ahrefs membership.

Anchor Text Data

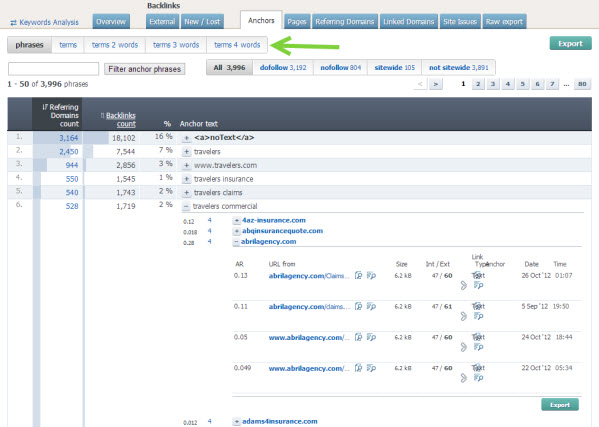

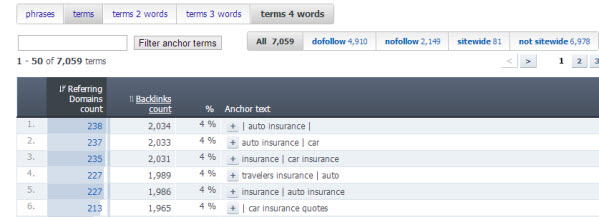

Ahrefs offers lots of data, you can see our full review here, on keywords, links, and general purposes competitive research metrics. Specifically, inside of their Anchors tab you’ll get access to the following

- Anchor text of the link

- Total links with a given anchor

- Unique domains relative to the total link count of a given anchor

- The % of the full link profile made up by a given anchor

- The domains where the links reside with an option to expand and see the pages on the domain with the actual link

- The ability to break down links by do-follow vs no-follow and sitewide vs not sitewide

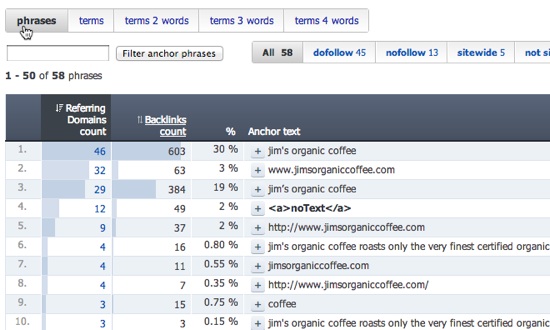

These features are shown in the following screenshot:

By far, my favorite piece of this module is what is next to the green arrow in the above screenshot. This represents not just the anchor phrases, but also specific groups of terms that make up your overall anchor text profile. This is helpful because:

- Sometimes Google will group an over-optimization filter on keywords that include not just the actual phrase but bits of the term as well

- You can quickly spot areas which appear to be over-optimized for a grouping rather than just a specific term

- You can group this data with the other filters I mentioned (dofollow vs nofollow, sitewide vs not sitewide, or all links) to quickly see what is really going on with your core keyword groups

- Ahrefs will show the same information when you break your profile down into terms (total links, referring unique domains, and percentage of links that contain a 1, 2, 3 or 4 word term)

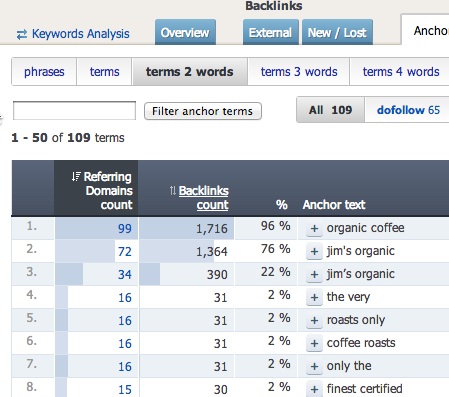

Digging into Phrases and Terms

When you look at phrases you are looking at the actual full anchor that resides on a given page. Whereas with terms you are seeing anchors that contain that particular 1, 2, 3, or 4 word term. If someone links to you with “auto insurance quote” as the full anchor, with no other words or characters in the anchor, then it will only show on the phrase report and not the 3 word term report.

I like how they do that because if they put it in both the phrase and 3 word report it would make the data less useful as it would not portray an accurate reflection of the question “what percentage of my links contain this keyword specifically and only versus what percentage of my links contain these pieces in a given anchor”.

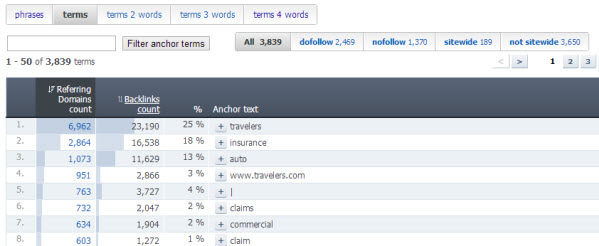

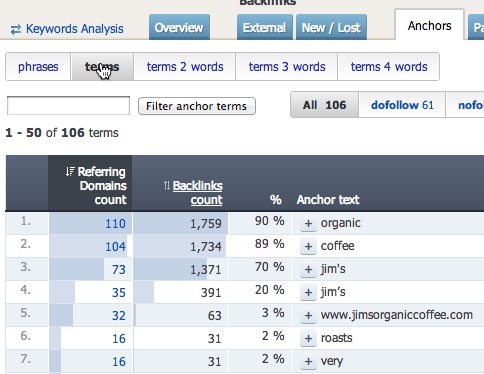

The screenshot below shows what a traditional, natural link profile tends to look like:

You can sort by any of the columns but here you an see that from a unique domain referral standpoint, the top 3 terms are essentially the company’s name and their most well-known product link with respect to singular terms that show up most often.

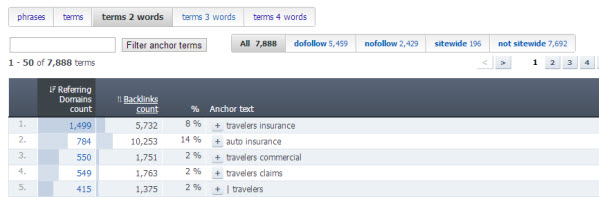

If we look at the 2 term report we begin to see which terms tend to define the product and brand:

What this report also shows is that even at a 2 term level many sites link to the domain with a brand component as well. Most commercial keywords are of the 2 and 3 word variety. The single term report generally is a good test for the branded nature of the links.

We saw in the single term report that the top 2 terms (in terms of unique domain count) were essentially part of the brand name.

This 2 term report is continuing to reinforce the branded nature of the site’s anchor text profile.

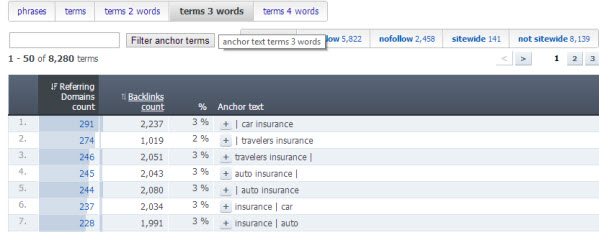

Now we can take a look at the 3 term report:

Here is where we can really start to see the most linked to commercial phrase(s). I do with Ahrefs would drop pipes and other characters from these reports and just focus on actual words but since Google generally looks at these characters as characters I suppose it’s somewhat ok to leave them in.

Given that the top-level reports have established Travelers and Insurance as 2 of the core terms (and thus branded) it’s likely that the words attached to these terms are branded terms as well. This helps in establishing a natural link profile.

If you think of these reports as a cascading group of reports you can see how branding can help significantly. In other words consider this:

- Phrase report sets the table for the whole link profile, what words are establishing the brand in the profile? Here it’s Travelers and Insurance. People refer to the site as Travelers Insurance

- The term report reinforces the most important singular terms, these generally should line up with the phrase report (again, Travelers and Insurance)

- The 2, 3, and 4 word reports likely contain commercial keywords and the hope is that you’ve been able to get some piece of the commercial references included into what words Google views as your branded terms

- Travelers has been able to establish the word Insurance as a part of their brand so when we see stuff like auto insurance quotes and such it is not all that unnatural to search engines because of the branded nature of this anchor text profile.

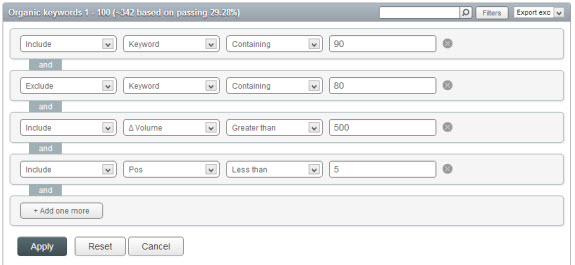

Next up is the 4 term report:

We continue to see the emphasis on car and auto insurance related keywords with word separating pipes that likely included branded terms before and/or after.

I would say that Travelers is well positioned for the auto/car insurance keyword group but they need to target the core terms better from an anchor text standpoint. From a marketing standpoint and a site standpoint Travelers tends to target a broader market of products then the other big insurers like Geico, Allstate, Progressive, and so on do.

Wrap Up

One module in a tool doesn’t tell a complete story nor does one tool. It is typically recommended that you use multiple tools to cross-compare different data points and metrics to come to proper conclusions or at least well-informed conclusions.

There isn’t another tool out there right now that combines this terrific feature with the speed and depth of Ahrefs. The specific module alone is worth the cost of Ahrefs in my opinion, it’s important to have a deep understanding of an anchor text profile and Ahrefs is the head of the class at the moment.

You can limited data with their free account or you can sign up to test it out in full, they do offer a 7 day money back guarantee.

If you do decide to sign up please take advantage of their current 50% off the first month coupon (20% off annual as well).

Research Subdomains with SemRush

1

Have you noticed a rise in content being pushed to and created on sub-domains of authoritative websites?

A strategy born out of Google’s Panda update (and subsequent iterations) has been to move specific content to its own sub-domain as a way of getting around being algorithmically viewed as a content farm. There are a few reasons for this and it is most effective when the sub-domain hangs off of an existing domain which has a fair amount of existing authority and trust.

Google initially treats sub-domains as somewhat separate sites, compared to the root domain, and over time most of the authority gained by the sub-domain can be passed back to the root, or pages on the root, via internal linking and vice versa.

Another point of interest with this approach is that penalties generally do not flow down to the root domain from the sub-domain so one can be a bit more aggressive on the marketing of the sub-domain and not worry so much about perceived lower quality stuff on the sub-domain taking down the entire root domain.

Bringing in SemRush

SemRush has consistently produced the best results for me, over time, with organic SEO data. Their interface is incredibly slick and has undergone frequent updates as the product has matured. Their updates are solid as well and they don’t try to give you all sorts of useless custom metrics that cloud the interpretation of the relatively clean data they provide.

SemRush groups an entire domain (subs and the root) when you search the core domain. At present, it is not possible to just search the sub-domain and the sub-domain data is only available to paying subscribers.

What I like about the domain grouping is 3-fold:

- You can uncover sub-domains you might have not already known about

- They have generous export limits and multiple pricing tiers so you can get all the keywords (sub-domain and root domain) you need on a site.

- You can cross compare rankings from root domain and sub-domains to get a sense of the overall strategy of the site in question

Rarely have I run across a research project where I couldn’t get all the data I needed. They have plans that allow for the exporting of anywhere between 10,000 and 100,000 keywords as well as giving you 3,000 to 10,000 requests per day (tons of data).

If you have a really large project outside of the above-mentioned limits, you can request a custom data report from them as well.

Hunting Down Targets

Some of the best targets will be found by simply following trusted news sources to uncover these kinds of strategies. In the linked to article you’ll see a self-professed Panda recovery from Hubpages via the “moving content to sub-domain” route.

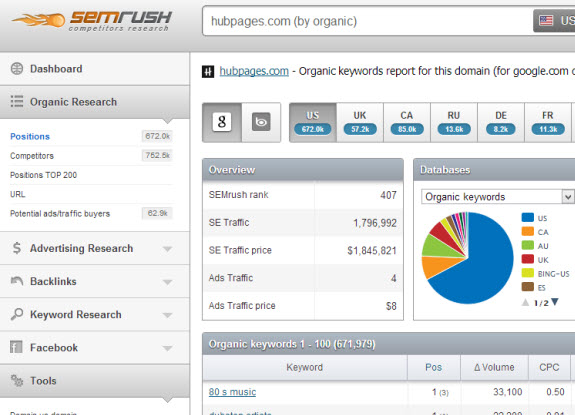

As you can see from this chart there was a huge drop post-Panda and then a subsequent recovery for a period of time and then a somewhat noticeable slowdown but it certainly appears as if their strategy worked for awhile (definitely long enough for them to have the opportunity to right the ship or figure out a new approach or what have you)

Some other ways to check on prospects for research would be to cobble together various Panda “Winners and Loser” lists. You do not necessarily need to target just winners either. Remember, the goal is to uncover keywords for your campaign(s).

Researching a site that made these kinds of changes and benefited would be a benefit for me, not a necessity. Plus, some of these lists might be taking into account the success of the root domain itself, not necessarily new sub-domains in addition to the pure root domain.

In addition to all that, you can gather both keyword and content ideas from either winning or losing sites (in those lists). The keywords and content are likely still worthy to pursue but the execution might have been poor on a losing site or that losing site might have got hit by another, somewhat unrelated algorithmic update (Penguin, for example).

Here some of the initial lists:

- SeoBook’s Initial Analysis

- 1st Round from Search Metrics

- Late 2011 List from SearchEngineLand

- 1st Quarter 2012 SearchEngineLand

Using SemRush

So let’s take HubPages as an example. What they did (mostly) was to take their author pages and move them to sub-domains. Topical and category-level pages remain off the root domain while they’ve taken the unique author articles and published them to their own sub-domains off of the root hubpages.com

SemRush also incorporates Bing (as you’ll see in the image below) so you can utilize that data as well but for the purposes of this post we’ll be focusing on Google in the US (note they also have many countries available too).

For the sake of image clarity the single screenshot of the initial results page is broken up into the left page (1st image) and right page (2nd image) so you can clearly see all of the data and options:

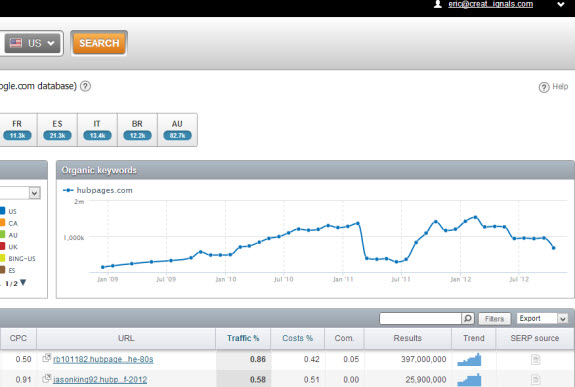

So, initially, we are looking at over 670,000 keywords! Well, chances are you really don’t need all that data. Fortunately SemRush has some killer filtering available pre-export. Your options are:

- Include/Exclude chosen parameters (see following bullet points)

- Keyword, URL with options for containing, exactly matching, beings with, ends with

- Current ranking position, CPC with options for equal to, less than, greater than

- Traffic %, Cost %, Competition, & Total Results with options for equal to, less than, greater than

As you can see, these make for powerful filtering options since you can combine them. There really is no limit on filters you can add as many filters as you want! These filtering options make it super-easy to find specific keyword targets (or a specific author in the case of Hubpages)

Hubpages covers a ton of topics so you might be just interested in a few.

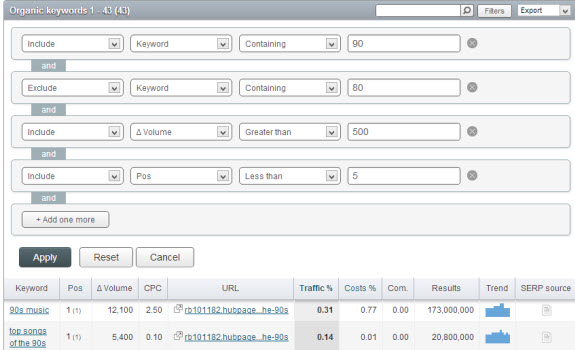

Let’s assume you dig 90’s music and want to start a site about that. Simply click on the Filters button below the organic keyword chart and start adding in filters:

Here, I’ve included keywords that contain the word 90, have a volume of greater than 500 searches per month in Google, excluded 80 in case any of those snuck in, and asked that only keywords where Hubpages ranks less than 5 are shown (I want to see their most important keywords).

Now we are left with only 43 keywords out of 670k+ and the beauty is that when we export we are given the filtered data.

Hitting Sub-Domains

You might have guessed this already but now we can dive right into sub-domain research.

We can clear out all these filters and show only the sub-domain of this specific author. You might already know the sub-domain you want to research, if so you can considerably cut down your research time using these powerful filters.

If I wanted to dive more into this specific sub-domain all I would have to do is copy the sub-domain and add it as a filter (now I have 30k+ results off of this sub-domain only).

This is why SemRush is my tool of choice for sub-domain research. You can take any sized site and quickly whittle down to the specific product, author, topic, etc that you need or want to research.

Give SemRush a try today, it really is one of the best tools on the market.

Researching Affiliates with Keyword Spy

15

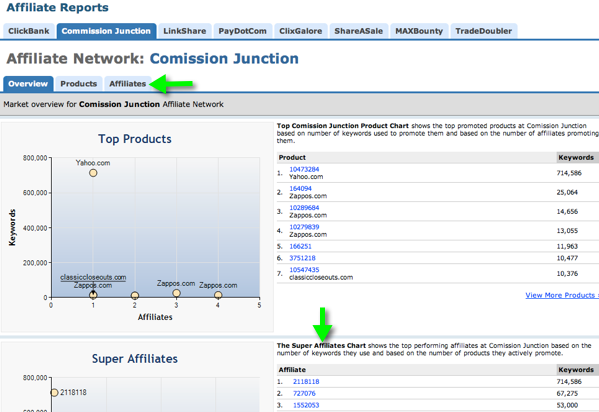

A unique feature of Keyword Spy is the ability to research affiliate and affiliate network ads. As part of their Professional membership package they offer you the ability to get in-depth data about top affiliates, affiliate products, and affiliate networks.

The Affiliate piece of your Professional membership offers the following:

- access to over 60 networks, 4,000 products, and 2 million ads

- specific product and super-affiliate data from Clickbank, Commission Junction, Link Share, PayDotCom, Clix Galore, ShareASale, MAXBounty, TradeDoubler.

- anti-cloaking technology that they claim helps find data on affiliates who cloak links

- daily updates to networks, products, affiliates

- search by affiliate ID, product ID, affiliate URL, and affiliate network name

Researching Networks and Products

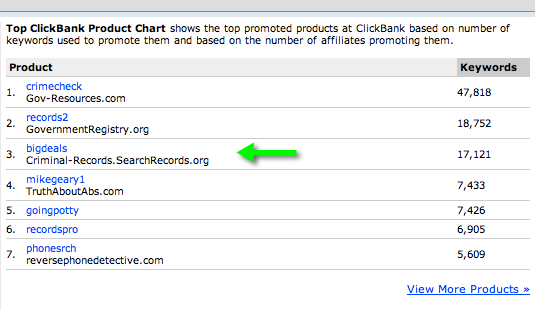

Let’s say you know the ID of a product you want to research and you want to research current ads for that product. You decided to go with the following product from Clickbank:

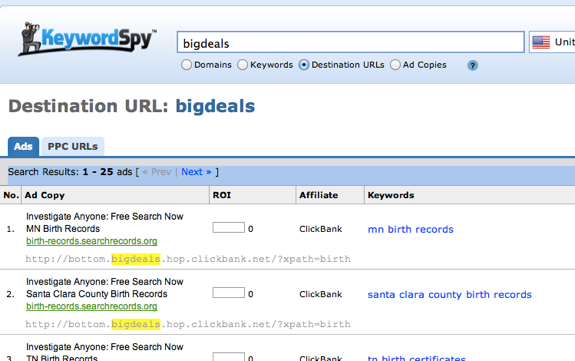

With this product ID, or any product ID from the 8 Affiliate Report networks (remember, only Clickbank, Commission Junction, Link Share, PayDotCom, Clix Galore, ShareASale, MAXBounty, and TradeDoubler have this feature, the 60+ other networks only show data based on their advertiser URLs), you can jump right into a Destination URL search and see all the ads Keyword Spy has found with the product ID in the landing page URL (usually it’s just the affiliate link itself):

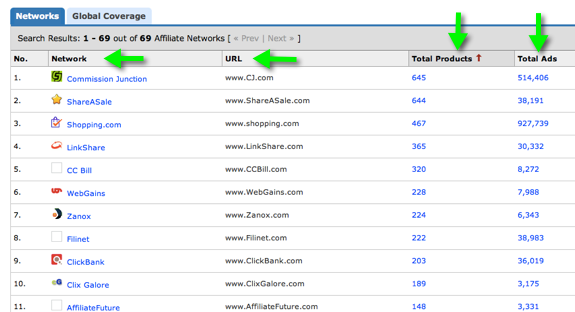

If you happen to researching another affiliate network that doesn’t fall into the group of 8 where affiliate ID’s and product ID’s are available, you can still pop a URL in the destination URL search and sort to find specific affiliate ads. While the Affiliate Report section gives you access to the 8 networks, their products, and their affiliates it is the Affiliate Intelligence section which gives you access to the rest of the networks (and the 8 mentioned above as well):

The Affiliate Intelligence section shows you:

- the affiliate network

- total amount of ads for that network

- url of the network

- total amount of products for the network

Keyword Spy has approximately 77 products and 1,341 ads for the Pepperjam Network. You can click on either the domain name, the total ads, or the total products and be brought into the section that breaks down the products the tool has information on:

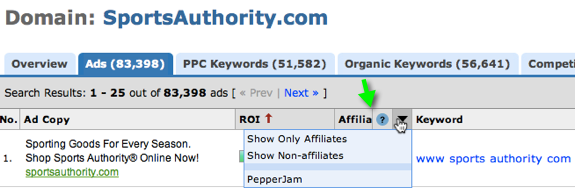

By far, the most ads here falls under the Sports Authority affiliate program. If you wanted to just research the Sports Authority domain you could just click on the URL to get back to the full research module on Keyword Spy (where you can also look at ads and filter for affiliate ads)or you could just click on the ads area to see current affiliate ads for this program:

You can do affiliate ad research on any domain you’d like, simply enter the URL then click on ads then sort by affiliate only. I like to use the Affiliate features on Keyword Spy to evaluate and see what products exist on certain networks.

Gathering the Affiliate Data

Once you are looking at the affiliate-only ads, you’ll find that you get the same standard data points offered when you conduct traditional research methods inside of this tool. You’ll get:

- Ad Url

- ROI (a custom metric determined internally by (Days Seen*Percentage Seen)/Number of Days Seen since Last Seen)

- Name of Affiliate Network

- Keyword being Bid On

- Estimated Volume

- Estimated CPC

- Last Seen Position & Average Position

- Days Seen/Days Checked

- Last/First Seen Dates

- Related Keywords

- Ad Copy

What I generally like to do, for organic SEO, is to export the affiliate ads data (specifically the keywords)and check the search volume to determine what keywords I might want to add or consider for an organic SEO campaign.

I would check the rankings of those keywords with a robust rank checking tool like Advanced Web Ranking and have the tool grab the top 10 competing results as well. I’d use a domain that wasn’t ranking so I could get the top ten sites ranking for each keyword and begin to evaluate the competitiveness from there.

Another thing I like to use this part of the Keyword Spy tool for is to come up with ideas for my own affiliate products (specifically information products) which I could create and market to some of the super-affiliates and/or affiliate networks that might be a good fit based on data given to me by this part of the Keyword Spy membership.

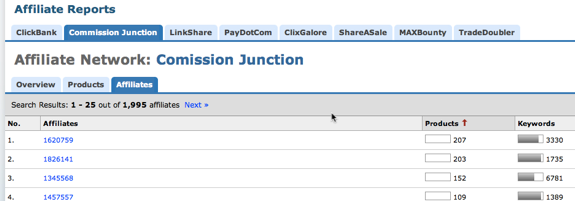

Researching by Affiliate ID

You can search by actual affiliate id’s inside of the following networks on Keyword Spy:

- Clickbank

- Commission Junction

- MaxBounty

- Trade Doubler

- LinkShare

- PayDotCom

- ClixGalore

- ShareASale

All you have to do is select one of the networks and click in either of the two areas noted below to check out the affiliate data of specific affiliates on these networks:

From here you can sort by total products and/or total ads. I sorted by total products and selected the first affiliate listed:

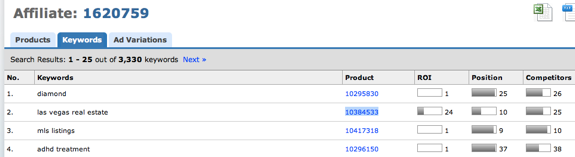

Once you click on a specific affiliate you can start digging into their data:

The affiliate detail screen will show you all the keywords and products (by product ID) the affiliate is advertising on in addition to the position of the paid ad and the competitors for the keyword being bid on. You can tab between keywords, products, and ad variations which are being used by the selected affiliate.

Another thing you can do, if the affiliate network you are researching doesn’t have the affiliate ID feature, is to find affiliate ads by doing a keyword search and then using the affiliate link as a destination URL search.

You can also do this if you happen to know a competitor’s affiliate ID (might not be hard to find on sites where the affiliate doesn’t cloak their links). You would follow these steps (assuming you didn’t have the actual affiliate ID yet, if you do then just input that in the search box, select destination URL, and click search:

- search for a keyword in the research section

- click the ads tab for that keyword

- select “show only affiliates” so that the only ads you see are actual affiliate ads

- check the destination link by clicking on the information icon next to the ad

- copy and paste the affiliate ID (not the whole URL) into the search box, select destination URL, and then you can see what other keywords and/or products the affiliate might be running under that specific ID

Affiliate Research Options

You have to have the Professional membership in order to use this tool. Keyword Spy offers 3 membership options, Research, Tracking, and Professional. Once you activate your Professional membership you’ll get access to over 60 networks and millions of ads to research as well as competitive research data on thousands of products.

Keyword Spy is the only major competitive research tool that offers in-depth Affiliate Research. Also, you will get instant access to the ads and products super-affiliates at 8 major affiliate networks are promoting along with statistics to determine what is and isn’t profitable for them.

Give Keyword Spy’s unique Affiliate Research tool a try today, you can sign up right here.

An Introduction to Competitive Research

1

The key to doing effective, proper, and relevant competitive research is to look at who you are actually competing against.

There are a variety of ways to accomplish this and depending on your market and your goals it might make sense to introduce different tools for different purposes, but when evaluating competition in the SERPs for organic SEO I like to start with two of my favorite tools; Ahrefs.Com and SemRush.Com.

Tools cannot replace experience, foresight into where search or this particular SERP might be heading (think Travel, Credit Cards, Shopping, etc), and gut feelings but this process will give you a clear picture into who you are competing against and the hurdles you are likely to face.

So let’s say I’m competing in the organic coffee space. Maybe I want to start an actual coffee company, or build a resource site, or do something with private labeling, drop-shipping, or affiliate products. I usually grab the top 5 non-wikipedia sites for the core term and begin narrowing down my research there.

Some SERPs will have shopping inserts and a local result or four (in this niche anyhow) but generally the top 5 domains will give you an idea of who is doing a better job overall, who is trending up or down, and who you really need to go after to win in this particular market.

Before the research starts we’ll grab the top 5 domains ranking in Google for organic coffee:

- DeansBeans.com

- JimsOrganicCoffee.com

- StrictlyOrganic.com

- OrganicCoffeeCompany.com

- GroundsForChange.com

You could really spend all day pulling reports for each site, combining and deduplicating spreadsheets, building your own charts, and so on but I think to look at top competing sites at a high level and allocate research time to the stronger sites I need to beat in order to make the organic SEO piece of my marketing a successful one.

When a few drops in positioning means going from double-digit percentages of clicks on the query to single digits it really drives home the point that you really need to rank in the top 2 or 3 for your core terms in order to fully realize a worthwhile ROI. While the SERPs are not an exact science, if you can identify the best performing site (or two) and design your strategy on beating them, your chances are exponentially better at success for a particular term.

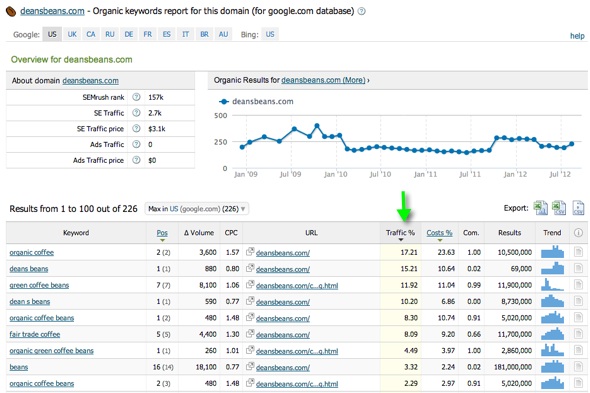

Starting off with SEMRUSH

SemRush has a variety of tools that you can come back to for individual domain and keyword research but for now we are going to focus on comparing these domains to see who is the stronger organic SEO play.

For organic comparisons you can start by heading right into their Domain Comparison features. Here, you can compare up to 5 domains for various paid search and organic search metrics. We’ll be focusing on the organic metrics:

- Number of keywords ranking in Google

- Overall traffic estimates based on ranking and estimated click rates by ranking position

- Overall value of traffic (CPC data meshed together with volume estimates)

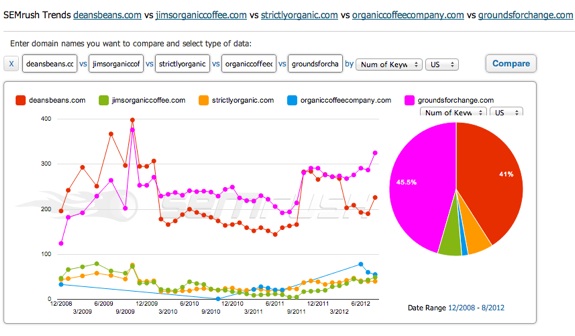

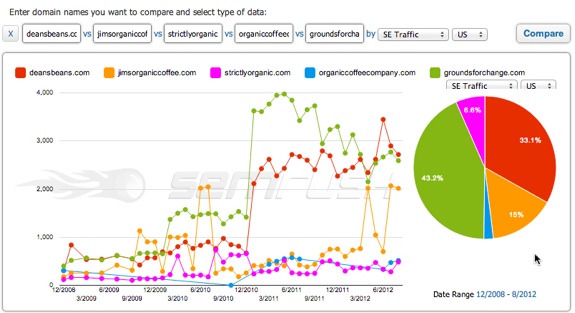

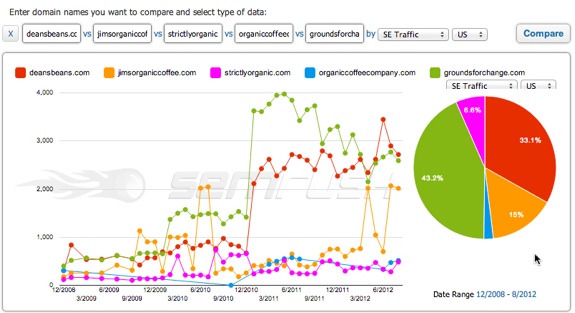

On comparison you can see that while the bottom few domains are trending up over the last year there are clearly 2 sites owning most of the space with respect to the overall number of keywords found ranking in Google.

You can hover over the smaller pieces of the pie to see total keywords and percentages when they are hidden given the small size of the pie. The next thing to look at is overall search traffic:

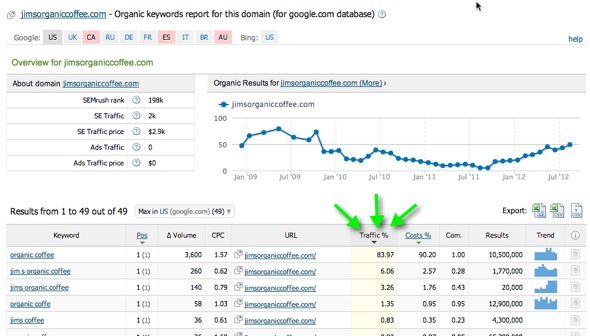

You can see where jimsorganiccoffee.com took about a 10 percent rip from deansbeans.com when compared to total keywords ranked for. This could be interesting because it could mean that Jim’s is ranking higher for keywords with more volume or it could mean that perhaps Jim’s benefits from more branded queries. This is something I would make a note of for future research.

We also have to keep in mind that some of these sites might sell additional stuff that we will not be selling; this will become clearer during additional research.

Next up is the last comparison piece in this section; the Traffic Value estimate (combining estimated volume and estimated CPC’s):

From here we can see that we should probably be concentrating our research on three of these domains. We still need to figure out where the spike in traffic and value is coming from off of jimsorganiccoffee.com but for now I would be comfortable limiting most of my research to these three sites.

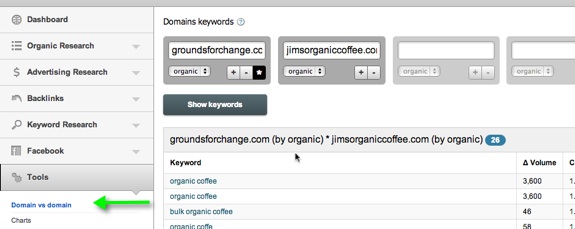

The other tool in SemRush you can use to compare domains is the Domain vs Domain feature.

Here, you can enter up to 5 domains and get common keywords that they all rank somewhere for. This is a good way to find organic keyword overlap but what’s really cool is if you click the asterik (in the image above) you can compare 2 domains and where each ranks for common keywords.

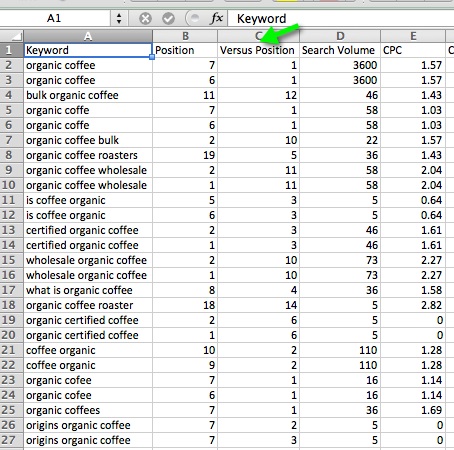

So, getting back to that jump in traffic and price for jimsorganiccoffee.com I compared it to both groundsforchange.com and deansbeans.com. Note that the domain that has the asterik icon clicked is the one that shows up in column B (Position) while Versus Position is the second domain (Jim’s in this case):

Compared to GroundsForChange.com

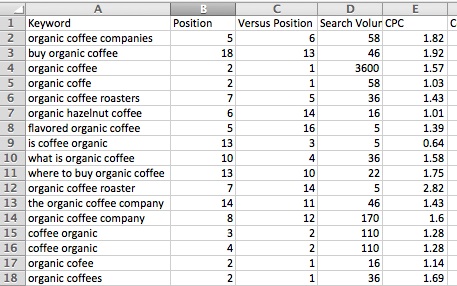

Compared to DeansBeans.com

So far, it appears that ranking number 1 for that core term “organic coffee” is a driving force behind those increases in traffic and traffic price from earlier comparisons.

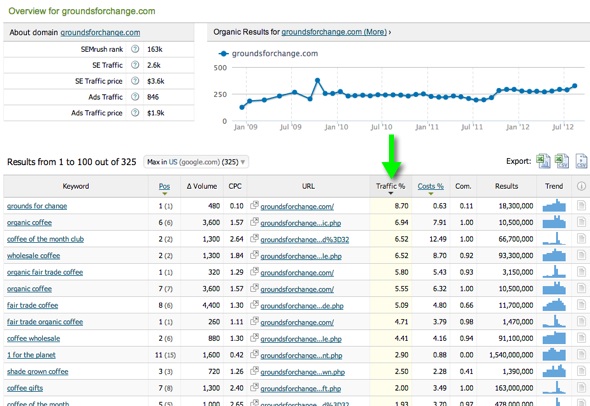

Breaking it down further, you can dig into each domain individually and see a better representation of their keyword spread:

GroundsForChange.com

DeansBeans.com

JimsOrganicCoffee.com

Clearly, we can see that Jim’s gets almost 90% of its estimated traffic from that core term and the next highest ones are branded. We will certainly keep this site for further analysis to try and see how that ranking was achieved but we also need to keep the other 2 as they rank for a much wider array of terms that probably matter to our site.

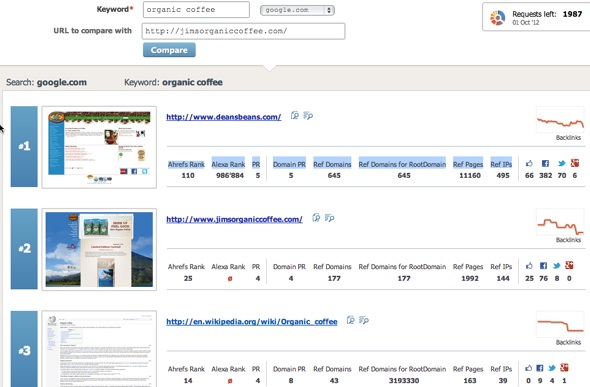

Bringing in Ahrefs.com

The usability of this tool, the depth, the freshness, and the additional features really make it my first choice for quick and relevant link analysis.

Ahrefs does a lot more than just pure link analysis. They have incorporated SemRush-like features into their competitive analysis as well as social data for given domains.

One place I like to start is the competition analysis feature. Here, you can see the following data points for the results in the top ten for a given keyword (in addition to comparing the result set to your chosen URL, jimsorganiccoffee.com in this case)

- Ahrefs Rank

- Alexa Rank

- PR

- Domain PR

- Ref Domains

- Ref Domains for RootDomain

- Ref Pages

- Ref IPs

- Likes

- FB Shares

- Tweets

- +1’s

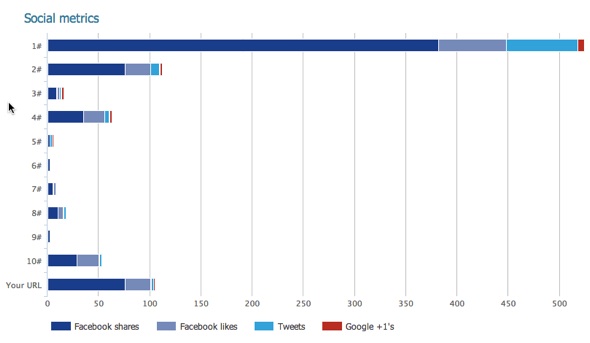

There are other charts similar to this which compare all of the above metrics in an easy to read bar graph format, for the sake of summarizing I’ve included the social metric chart:

In various ranking checks, DeansBeans.com and JimsOrganicCoffee.com flip flop between #1 and #2 and you can see where DeansBeans.com is way ahead of the pack in terms of raw metric counts (not so much in PR or various 3rd party authority formulas like referring IP’s, social data, root domains linking, and so on.

You can also go with the batch comparison tool in Ahrefs and see data for the specific entered URL (if a page is ranking instead of a domain for example) similar to the metrics mentioned above but also including a breakdown of linking edu’s, .gov’s, no-follow links, etc.

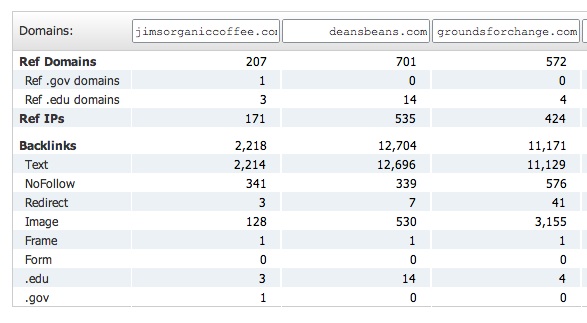

I like to use their domain comparison tool to get a quick raw count overview:

Jim’s is likely to be benefiting from having the keyword in their domain (a partial exact match) as well as probably having lots of natural branded links which also contain the target phrase.

Now, Ahrefs is a full-featured tool that is also very useful for ongoing research and for tracking linking patterns of competitors over time as well as tracking the effects of your own link building efforts. In this example, we are doing the initial competitive research on the potential competition so we need not use every tool they have. I do encourage you to test them out though, it really is an excellent set of tools.

Now that we’ve been able to see the lay of the land, it’s time to look at the individual backlink profiles of each competitor to check out quality and quantity of links and their corresponding anchor text break downs.

For these checks I like to go into their Site Explorer and check out a fresh view of the link profile.

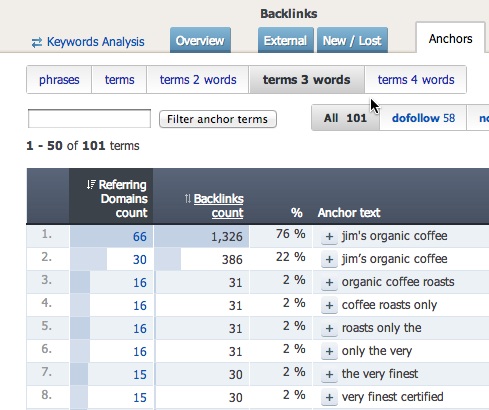

For JimsOrganicCoffee.com I see this:

You can click the + button to see the linking domains for the phrase and they are pretty solid (or at least “real” links) on top of being a very natural looking link profile.

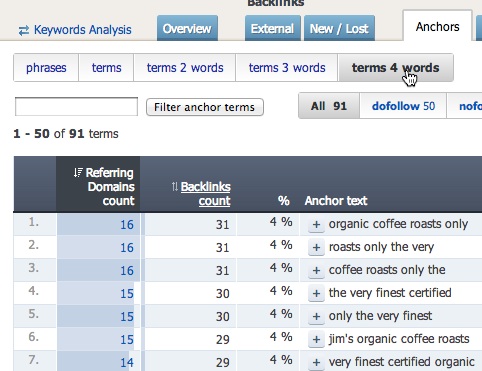

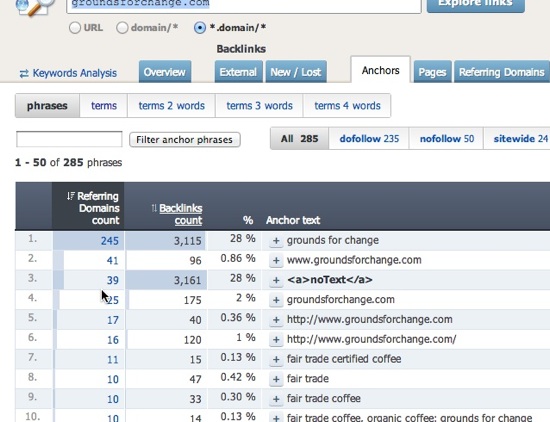

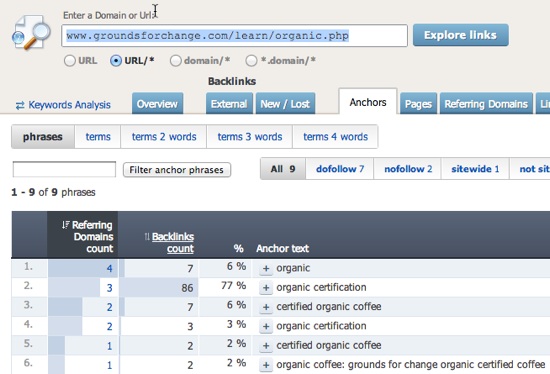

You can break down the profile further, into singular terms, 2, 3, and 4 term phrases in regards to the anchor text breakdown. This really helps get a good, high-level view of the anchor profile across the board. As you can see with Jim’s, it all appears to be very natural and the site is certainly benefiting from the partial exact match domain (in terms of link anchors, as there is no bonus for partial exact match domains on their own).

Here are the 4 profile reports for JimsOrganicCoffee.com:

<

Breaking it down further, below you can see the anchor profile for DeansBeans.com and GroundsForChange.com. DeansBeans.com is certainly heavily weighted towards their brand name but since their brand doesn’t have the core keyword in it, while a competitor’s does, they are losing out on anchor text relevancy but their brand strength and shear link count/quality are making up for it.

Also, GroundsForChange.com is more heavily weighted towards Fair Trade related keywords but their sub-page is ranking for the term we are looking at based on the strength of the overall domain (which is why we selected it for further analysis), a nice keyword rich internal link on the homepage (of a strong domain), and a targeted link profile for the ranking page:

Summary

Both tools here have keyword research and link components (SemRush’s is in beta but available) but I think to maximize the use of SEO tools by using the tool’s core strength(s). If cash flow is tight you can always rock one tool for this kind of initial analysis but using the tools properly should eventually pay off financially for you via your online marketing efforts.

You can dive deeper into each domain over time, as you compete with them for your chosen keywords, or during this research you might decide to go a bit more lateral and add more domains to the mix.

This is the general format I like to follow when conducting some initial, keyword-level competitive research. It typically gives me a rough idea (nothing is ever exact) of what I’m up against and how they got there, in addition to holes in their campaign where I might be able to pick up some additional wins.